WELCOME TO SECURITIZE MARKETS

Diversify Your Portfolio with

Private Market Investments

Exclusive investment opportunities from best-in-class asset managers like KKR and Hamilton Lane. Find out how to access:

| Our growth & yield funds

| Investment minimums as low as $10K

| Shorter lock-ups with liquidity potential

Past performance not indicative of future performance. Growth reflected not inclusive of fees.

*An equal-weighted average of all state funds who reported private equity returns in annual ACFRs for June 30 fiscal years 2001-2021. The equal-weighted average return of 19 state funds who reported private equity returns across 21 fiscal years equaled 11.5% per annum.

**A public stock benchmark weighted 70% to the Russell 3000 Index (7.71% annualized return over 21 years) and 30% to the MSCI ACWI ex US Index (4.78% annualized return over 21 years), with assigned weights reflecting regression-based weightings (a.k.a. “style analysis”).

Public equities may provide capital appreciation and liquidity but can be volatile and carry tax implications such as capital gains. Private equities, targeting long-term growth, typically involve higher costs and risks, offer limited liquidity, and are valued less frequently. Investors should recognize the distinct characteristics and risks of different investment types and are advised to consult financial professionals to ensure their investment choices are in line with their financial objectives and risk tolerance.

$400M

Total Invested1

531K

Investors Served2

3%

Selection Rate

0.5%

Management Fee

1Total dollar amount (USD) invested through the Securitize platform since inception, across broker-dealer and transfer agent entities. Data as of January 2024.

2 Total number of investor accounts. Data as of January 2024.

INVEST WITH SECURITIZE

Explore Exclusive Funds From Top-Tier Managers

Like KKR & Hamilton Lane

Click here to request access to our investment opportunities

FEATURED IN

Click here to request access to our investment opportunities

Click here to request access to our investment opportunities

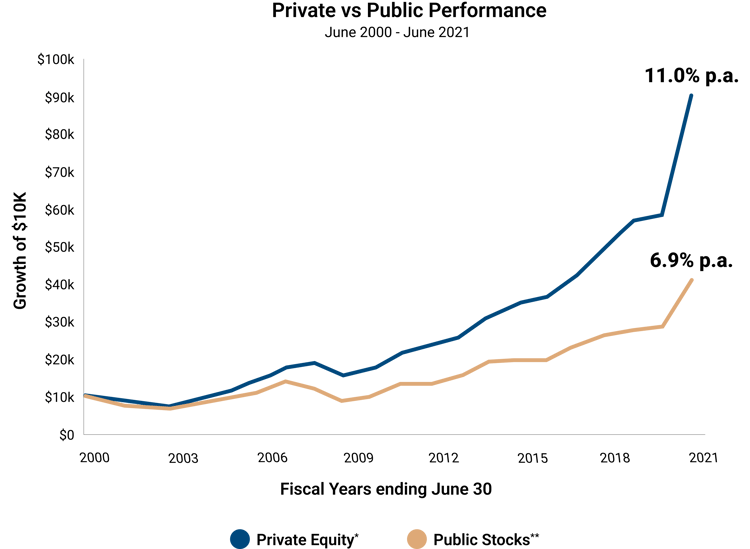

WHY PRIVATE MARKETS

The Growing Asset Class

Private markets are growing twice as fast as the public markets.

Past performance not indicative of future performance. Growth reflected not inclusive of fees.

*An equal-weighted average of all state funds who reported private equity returns in annual ACFRs for June 30 fiscal years 2001-2021. The equal-weighted average return of 19 state funds who reported private equity returns across 21 fiscal years equaled 11.5% per annum.

**A public stock benchmark weighted 70% to the Russell 3000 Index (7.71% annualized return over 21 years) and 30% to the MSCI ACWI ex US Index (4.78% annualized return over 21 years), with assigned weights reflecting regression-based weightings (a.k.a. “style analysis”).

Public equities may provide capital appreciation and liquidity but can be volatile and carry tax implications such as capital gains. Private equities, targeting long-term growth, typically involve higher costs and risks, offer limited liquidity, and are valued less frequently. Investors should recognize the distinct characteristics and risks of different investment types and are advised to consult financial professionals to ensure their investment choices are in line with their financial objectives and risk tolerance.

PRIVATE EQUITY INVESTING